HONESTY - EMPATHY - UNDERSTANDING

HONESTY - EMPATHY - UNDERSTANDING

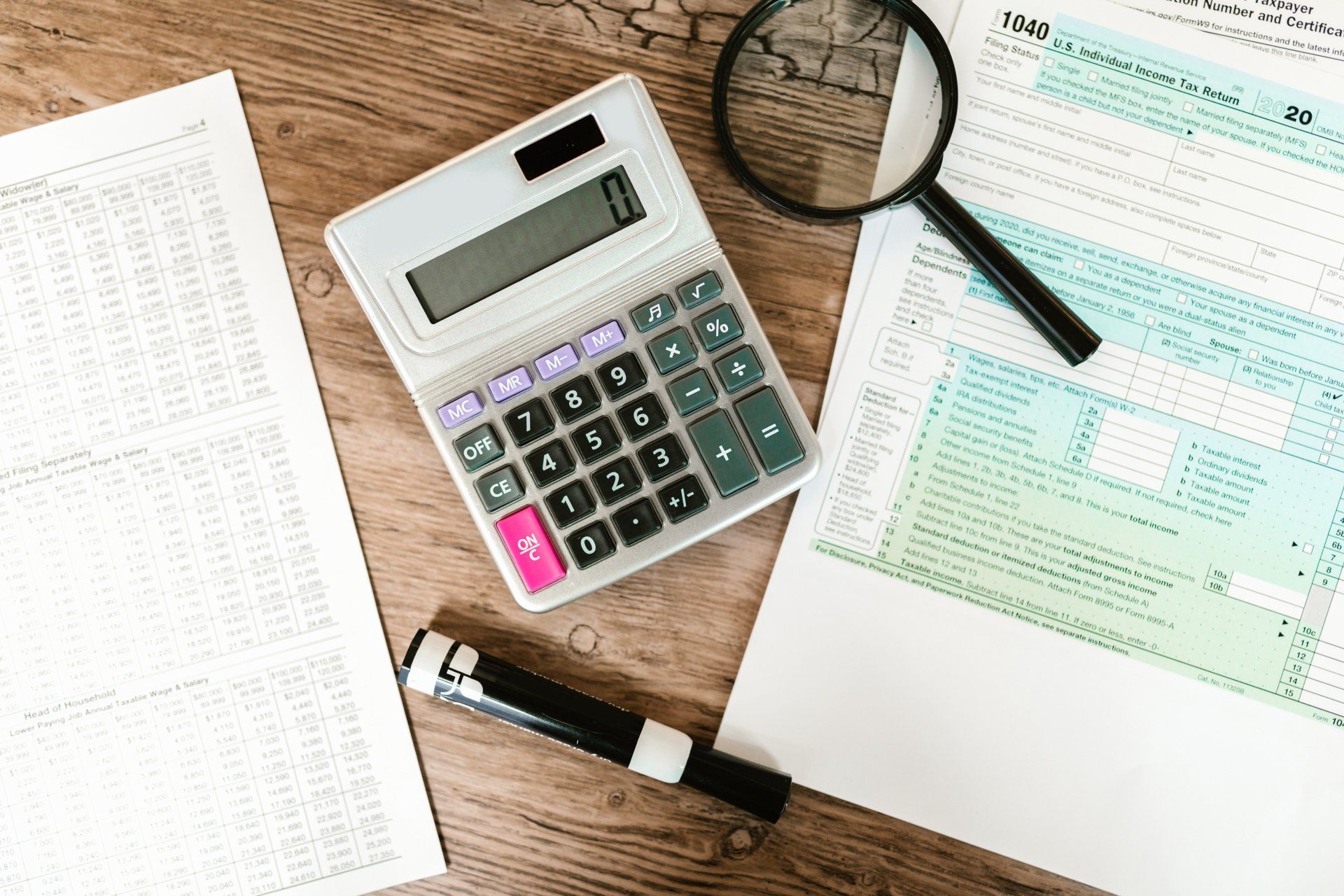

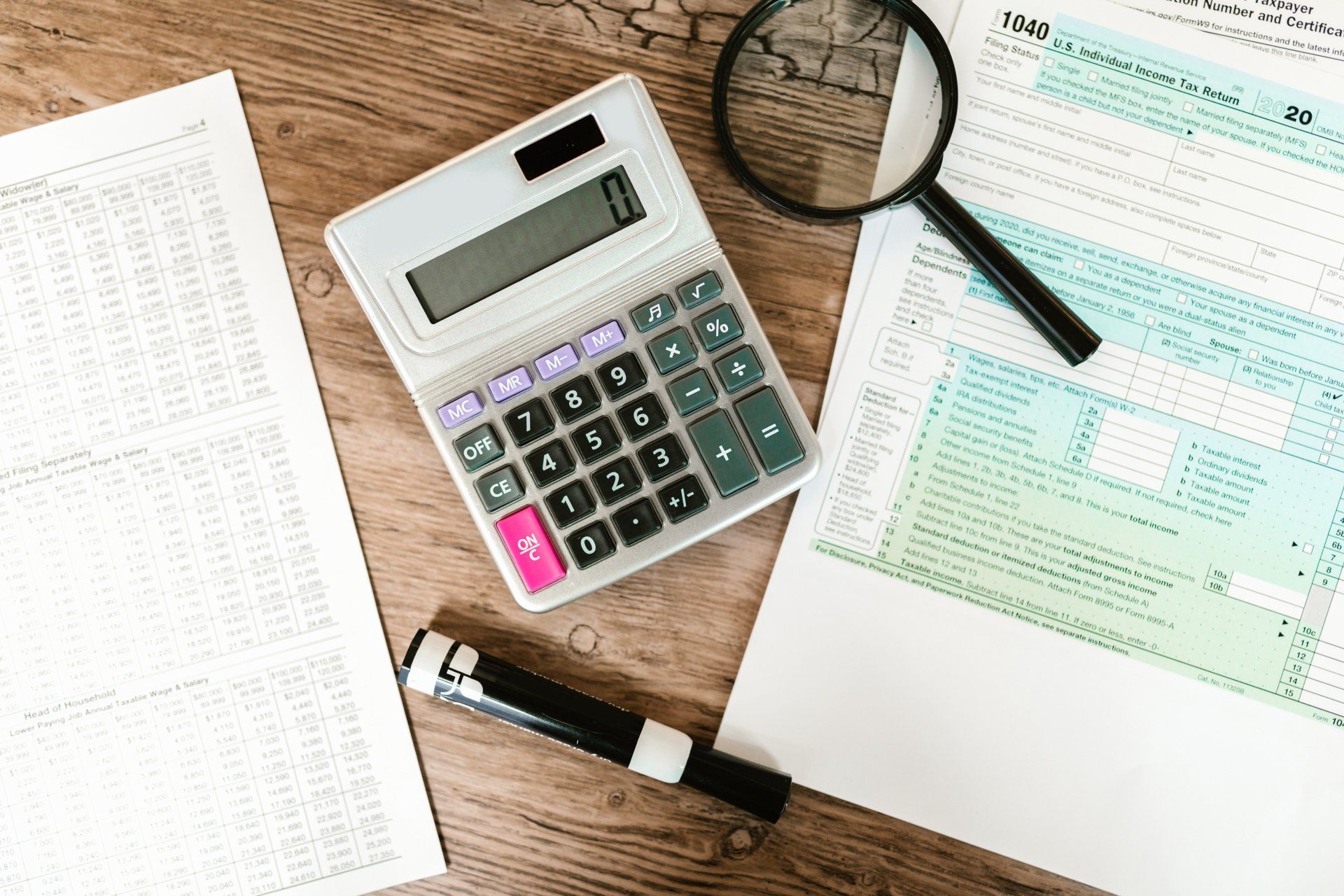

United Insolvency will not charge you a fee for initial information and signposting. If you were to proceed and implement a recommended debt solution where fees are applicable, full details will be provided before setting up. United Insolvency proposes and administers Individual Voluntary Arrangements (IVAs). Advice is provided on the basis that there is reasonable contemplation of an insolvency appointment, once it is apparent that an IVA is likely to be the most appropriate debt solution. The debt solutions offered by United Insolvency Limited only apply to residents of England, and Wales.

United Insolvency is a trading style of United Insolvency Limited, Company Number 11436761, registered in England and Wales, at Dalton House, Cross Street, Sale, M33 7AR.

Sharon Witley is authorised by the Insolvency Practitioners Association to act as a Licensed Insolvency Practitioner.

To qualify for an IVA with United Insolvency, you must have a minimum of £6,000 of qualifying unsecured debt owed to two or more creditors

There is potentially a debt write off in some IVAs. However, the amount of debt written off differs for each customer depending upon their individual financial circumstances and is subject to the approval of their creditors.

Data Protection Act Registration Number – ZA488958. To find out more about managing your money and getting free advice, visit Money Helper, an independent service set up to help people manage their money.

United Insolvency Ltd

Dalton House

Dane Road

M33 7AR

0800 048 9498